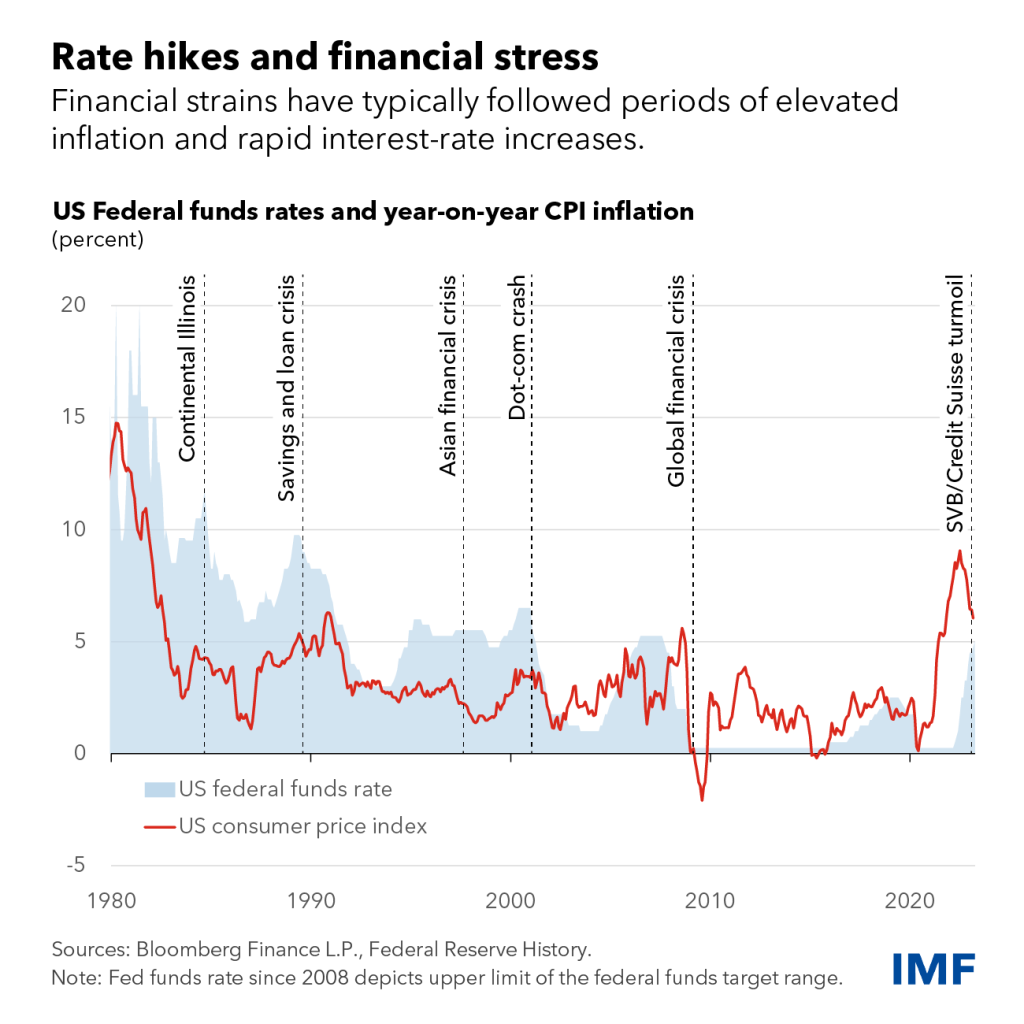

The Federal Reserve Raised Interest Rates by 0.25 Percentage Point

The Federal Reserve raised interest rates by 0.25 percentage point on July 26, 2023. This is the eleventh time the Fed has raised rates since March 2022. The Fed’s decision comes as inflation has been moderating in recent months, but it still believes that inflation is too high and that further rate hikes are needed to bring it down to its 2 percent target.

The implications of the Fed’s decision

The Fed’s decision is likely to have a number of implications for the economy, including:

- Slower economic growth. As interest rates rise, it becomes more expensive for businesses to borrow money and invest. This can slow economic growth, as businesses may choose to invest less and focus on paying down debt.Chart showing the relationship between interest rates and economic growth

- Dampened consumer spending. As interest rates rise, it becomes more expensive for consumers to borrow money and finance purchases. This can dampen consumer spending, as people may choose to save more and spend less.

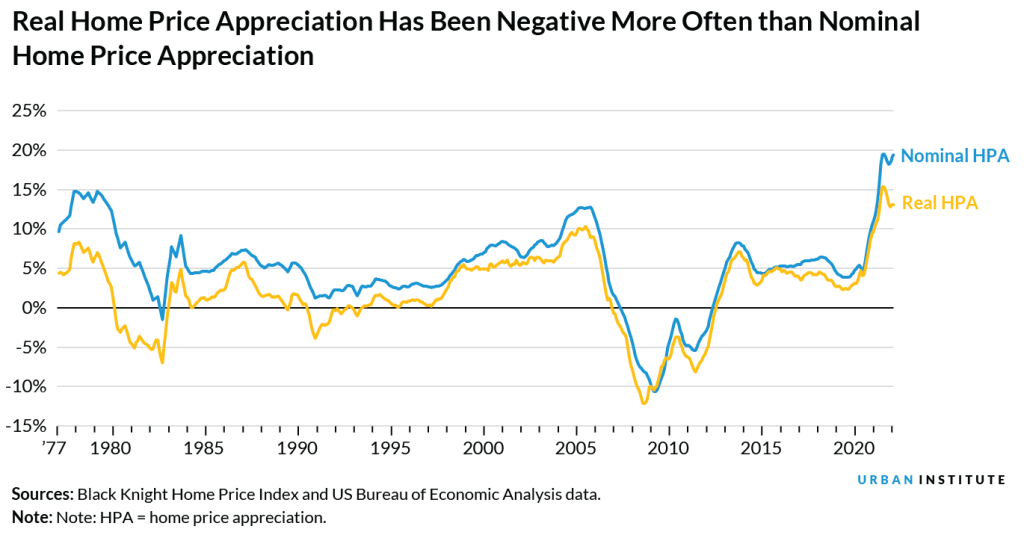

- Higher mortgage rates. Mortgage rates are closely linked to interest rates, so as interest rates rise, mortgage rates are likely to follow. This can make it more expensive to buy a home, which could dampen the housing market.

The effects of the Fed’s decision on the stock market and real estate market

The key effects of the Fed’s decision to raise interest rates on the stock market and real estate market are likely to include:

- Lower stock prices. As interest rates rise, the value of stocks can decline. This is because stocks are seen as riskier investments when interest rates are higher. For example, the S&P 500 index fell by 0.4% on the day of the Fed’s announcement.

- Increased volatility. The stock market is likely to be more volatile as interest rates rise. This is because investors will be more uncertain about the future direction of the market. The VIX index, a measure of stock market volatility, rose by 1.5% on the day of the Fed’s announcement.

- Shift in investment focus. Investors may shift their focus to more defensive stocks, such as those in the utilities and healthcare sectors, as interest rates rise. This is because these sectors are less sensitive to changes in interest rates.

- A decrease in demand for credit. As interest rates rise, people may be less likely to borrow money, which could lead to a decrease in demand for credit. This could have a negative impact on businesses that rely on credit to finance their operations.

- A stronger dollar. As interest rates rise in the United States, the value of the dollar is likely to appreciate against other currencies. This could make it more expensive for foreign buyers to purchase goods and services from the United States, which could hurt exports.

The full impact of the Fed’s decision to raise interest rates is still unknown, but it is likely to have a significant impact on the economy. Investors and consumers should carefully monitor the economic data and adjust their financial plans accordingly.